Introduction

Interest rates are a crucial component of student loans, directly affecting the total amount you’ll repay over time. Understanding how they work helps you make informed borrowing decisions and potentially save thousands in interest payments. This guide breaks down the different types of rates, how they’re determined, and what to watch out for when comparing loan offers.

1. What Is an Interest Rate?

An interest rate is the percentage a lender charges for borrowing money. For student loans, interest accumulates daily or monthly and is added to your loan balance over time.

2. Fixed vs. Variable Interest Rates

Fixed Interest Rate

- Stays the same throughout the loan term

- Predictable monthly payments

- Offered by most federal loans (e.g., U.S. Direct Subsidized/Unsubsidized Loans)

Variable Interest Rate

- Changes based on market conditions (e.g., LIBOR or SOFR index)

- Can start lower than fixed rates but may increase

- More common in private and international student loans (e.g., Prodigy Finance)

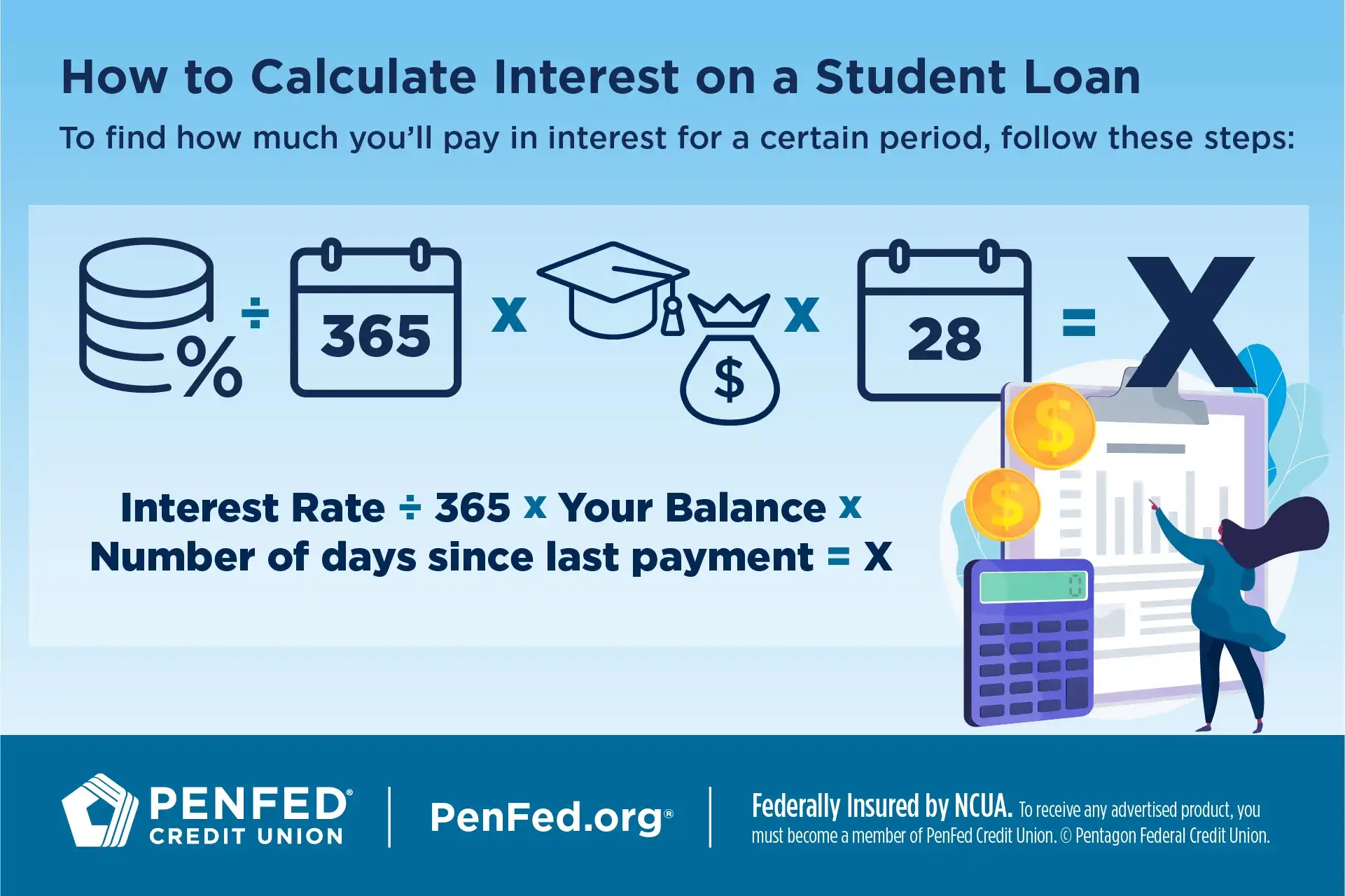

3. How Interest Is Calculated

Interest = (Principal × Interest Rate × Time) ÷ 365 (daily)

For example, a $10,000 loan with a 6% annual rate accrues about $1.64 per day in interest.

Capitalized Interest

If unpaid interest is added to the principal during deferment or grace periods, future interest will be calculated on a higher balance.

4. Average Interest Rates (Estimates)

| Loan Type | Rate Type | Typical Rate Range |

|---|---|---|

| Federal Direct Loans (US) | Fixed | 5.5% – 7.5% |

| Private Undergraduate Loans | Variable | 6% – 12% |

| MPower Financing | Fixed | ~12.74% |

| Prodigy Finance | Variable | 9% – 13% |

| Lendwise (UK) | Fixed | 7% – 10% |

5. Tips to Minimize Interest Costs

- Borrow only what you need: Don’t overborrow, even if approved for a higher amount.

- Choose fixed rates when possible: Offers payment stability.

- Make interest payments while in school: Reduces capitalized interest.

- Pay more than the minimum: Shortens loan term and lowers interest over time.

- Compare lenders carefully: Read the fine print on rate structures and fees.

6. Useful Resources

- Federal Student Aid Loan Simulator

Website: https://studentaid.gov/loan-simulator/ - MPower Interest Details

Website: https://www.mpowerfinancing.com/students/interest-rates/ - Prodigy Finance Explained

Website: https://www.prodigyfinance.com/resources/blog/student-loan-interest-rates/ - Lendwise Loans

Website: https://www.lendwise.com/ - College Ave Student Loans

Website: https://www.collegeavestudentloans.com/ - Sallie Mae Student Loans

Website: https://www.salliemae.com/student-loans/

Conclusion

Understanding interest rates is essential to managing your student loans wisely. Whether you’re considering federal, private, or international loans, take time to evaluate how interest affects your total repayment. Informed choices now can lead to significant savings and financial freedom in the future.